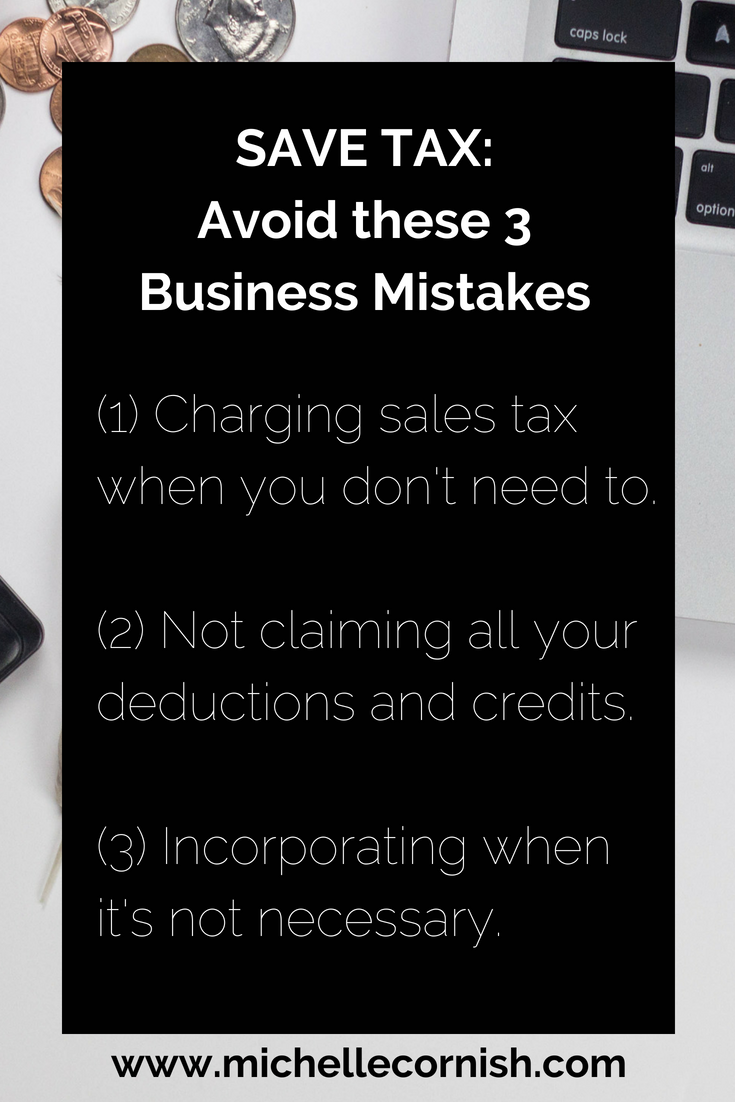

Want to Save Tax? Avoid These Costly Mistakes When Starting Your Business

/In my almost twenty years in the public accounting industry, there were a few questions I got asked almost every day: How can I avoid paying tax? How can I pay less tax? Why do I owe so much? Tax avoidance is illegal, and thank goodness, because there are a lot of essential government services taxpayer dollars pay for. The good news is, there are ways you can reduce your tax bill. For now, I’m going to focus on small business owners and the top three mistakes they can avoid to save tax.

Mistake #1: Charging Sales Tax When You Don’t Need To

Sometimes business owners are so excited to get started making money that they think they can make an extra 5-12% by charging sales taxes without checking into the rules. When you charge sales tax, you are holding the money for the government. It’s not your income and you owe that money to the government so don’t charge it unless you are required to.

In Canada, there are two sales taxes, the goods and services tax (GST), and the provincial sales tax (PST). In most circumstances, you’re not required to charge and collect GST until your business hits the $30,000 mark in gross revenue. There are some instances where you might want to register before you hit that goal, so be sure and check with your local professional accountant.

The PST is a different story. Most services and some products are PST exempt so, depending the type of business you operate, you might never be required to charge PST. If you are required to charge GST and PST, you’ll want to make sure you’re properly registered to do so and follow the appropriate requirements to avoid incurring filing penalties.

Mistake #2: Not Claiming ALL the Deductions and Credits You are Eligible For

The Canadian Income Tax Act is a really thick book and tax laws are changing all the time, which means it’s only growing in size. It’s important you know what deductions and credits you can claim in order to reduce your tax bill. For business owners that work from home, a commonly missed deduction is the business-use-of-home amount. This deduction allows you to claim a portion of your home expenses (e.g., utilities, property taxes, house insurance, and mortgage interest) as a business expense.

Another commonly missed deduction for business owners is for personal vehicles used in the course of business. If you use your personal vehicle for business activities, you may be able to claim a portion of the expenses required to run your vehicle (e.g., fuel, repairs, insurance) as a business expense.

Like many tax deductions and credits, there are special rules and caveats attached to the business-use-of-home and vehicle deductions, so make sure you check with your Chartered Professional Accountant (CPA) to find out if they are appropriate for you.

Mistake #3: Incorporating When It’s Not Necessary

While incorporating a business can save tax, when you are at the point in your business where you are using all the money you make to live, you won’t see any tax benefit from incorporating and you’ll end up paying more in accounting and legal fees than if you hadn’t incorporated. Many business owners mistakenly assume they are required to incorporate from the inception of their business. This is untrue and often unnecessary.

Saving tax is a very individualized endeavour dependent on each taxpayer’s specific situation. So please, please, please do yourself a favour and hire a professional. I’m sure your aunt’s best friend’s daughter who took a tax seminar once in college is a very nice person, but you want a professional who deals with all this tax stuff on a daily basis.

Finding an accountant can be intimidating. In Keep More Money I break down the key questions you need to ask an accountant to determine if they are the right person to work with. Click here to get a free chapter.